do nonprofits pay taxes on utilities

Taxes Nonprofits DO Pay. Federal and Texas government entities are automatically exempt.

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

What Does It Mean To Be Tax Exempt

A 05 county sales or use tax b local exposition taxes and c.

. Nonprofits and churches arent completely off of Uncle Sams hook. Licensed nonprofit orphanages adoption agencies and. Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing.

The research to determine whether or not sales. Employment taxes on wages paid to employees and. TaxAct helps you maximize your deductions with easy to use tax filing software.

Yet the parent Pepco Holdings did not pay income taxes during. Ad Filing your taxes just became easier. Many nonprofit and religious organizations are exempt.

501c3s do not have to pay federal and state income tax. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the. Pepco collected nearly 546 million from customers to cover its income tax bill for the years 2002 through 2004.

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. House Bill 582 which legislates the tax exemption. Any nonprofit that hires employees will also need to pay.

Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases. But they do have to pay. Florida law grants certain nonprofit organizations that meet the criteria described in Section 21208 7 Florida Statutes FS and.

However there are some situations where sales tax is not due. TaxAct helps you maximize your deductions with easy to use tax filing software. Ad Filing your taxes just became easier.

Nonprofit Organizations and Sales and Use Tax. Limited exemptions from the payment of Georgias sales and use tax are available for qualifying nonprofit organizations including. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

For not-for-profit entities NFPs payments in lieu of taxes PILOT are amounts paid to a state or local government in place of taxes most commonly property taxes. Most sales of food and beverages to governments are taxable. File your taxes stress-free online with TaxAct.

Sales to Government and Nonprofits. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount. File your taxes stress-free online with TaxAct.

Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. Sales of utilities such as gas electricity telephone services telephone answering services and mobile. At issue are the vast.

They must pay payroll tax all sales and use tax and unrelated business income. Taxes on money received. However this corporate status does not.

Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas. Under current law charitable nonprofits in North Carolina pay sales and use tax on their purchases and can apply for semi-annual refunds of the taxes they pay. Sales and purchases by nonprofit organizations t hat are subject to the 5 state sales or use tax may al so be subject to the.

New Sales-Tax Rules for Nonprofits.

Nonprofit Project Budget Template Seven Doubts About Nonprofit Project Budget Template You S Budget Template Budgeting Worksheets Budgeting

Tweaking A Tax Credit Would Help More Americans Go Solar Infographic Institute For Local Self Reliance

![]()

5 Steps To Prepare Your Business For Tax Season In Canada

Balancing Nonprofit Administrative Costs With Growth Netsuite

How Do Non Profit Business Owners Get Paid The Blue Heart Foundation

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

2020 Guidelines For A Nonprofit Reimbursement Policy

Calculate Overhead For Your Nonprofit Organization 5 Steps Freshbooks

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

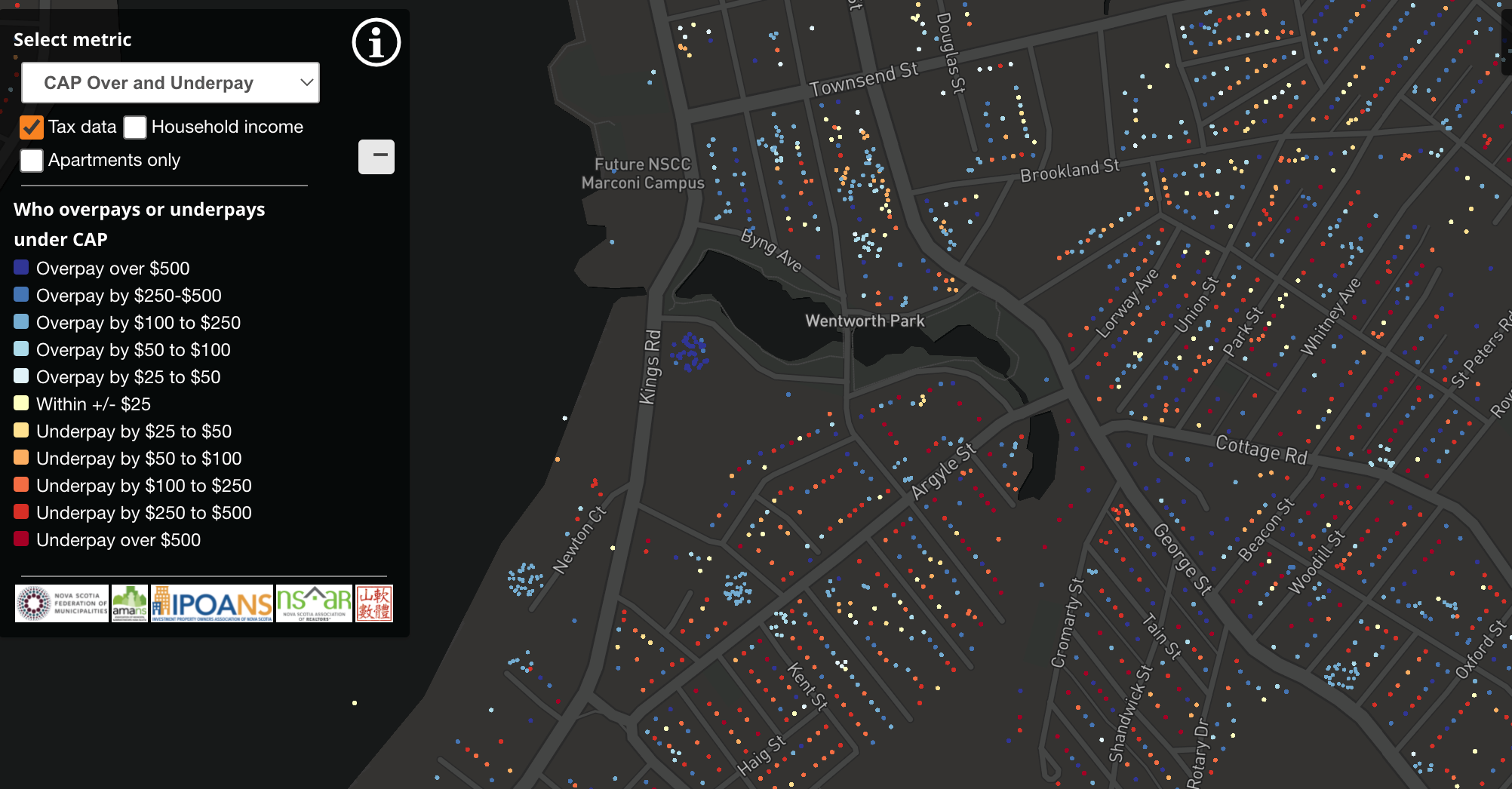

This Ns Map Shows Who Is Over And Under Paying Property Taxes Gocapebreton Com

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Five Rules For Buying A House And How Far You Can Bend Them Buying A New Home Life Hacks Home Improvement

/200270955-001-5bfc2b8bc9e77c00517fd20f.jpg)

Do Nonprofit Organizations Pay Taxes

What Is A Nonprofit Definition And Types Of Nonprofits 2022 Shopify New Zealand

:max_bytes(150000):strip_icc()/GettyImages-989124584-3d388da139694016a7c9da74898fb95e.jpg)